Why You Need To Select Credit Score Unions for Financial Stability

Lending institution stand as pillars of economic security for several people and neighborhoods, supplying a distinct strategy to banking that prioritizes their participants' health. Their commitment to lower fees, competitive prices, and individualized customer care establishes them aside from standard banks. Yet there's even more to credit rating unions than just monetary advantages; they also foster a feeling of community and empowerment amongst their participants. By choosing cooperative credit union, you not just safeguard your economic future but additionally come to be component of an encouraging network that values your economic success.

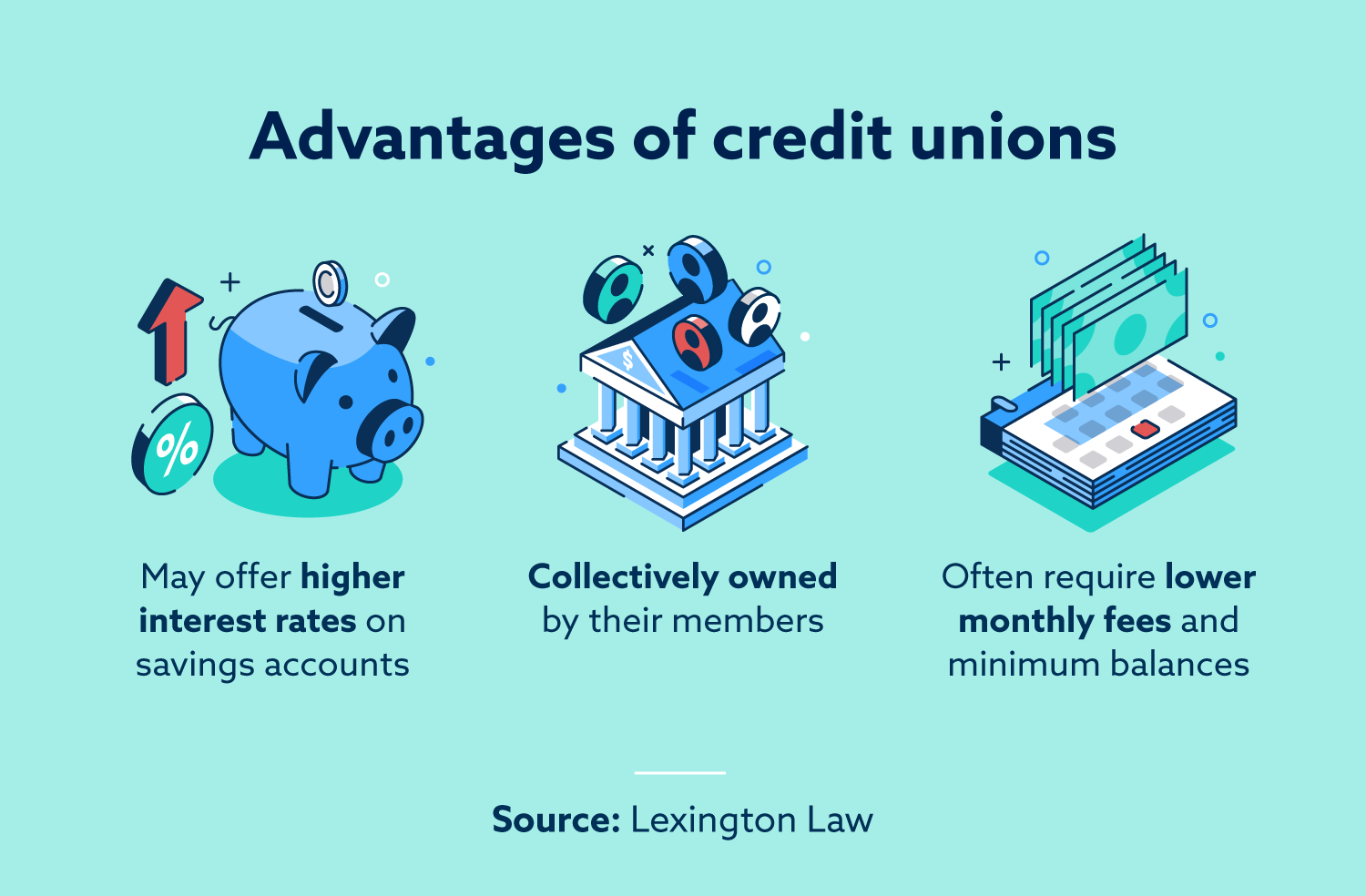

Lower Charges and Affordable Prices

Credit rating unions typically provide reduced charges and affordable rates compared to standard banks, providing customers with a much more monetarily steady option for managing their funds. Among the key advantages of lending institution is their not-for-profit framework, allowing them to prioritize participant advantages over taking full advantage of earnings. This distinction in focus makes it possible for credit unions to offer lower charges for solutions such as examining accounts, financial savings accounts, and finances. In addition, credit history unions commonly provide much more competitive interest rates on interest-bearing accounts and financings, equating to much better returns for members and reduced borrowing costs.

Individualized Customer Support

Supplying customized support and individualized options, credit score unions focus on individualized customer care to meet participants' details economic demands effectively. Unlike standard banks, cooperative credit union are recognized for cultivating an extra individual partnership with their members. This tailored technique involves recognizing each member's distinct financial situation, goals, and choices. Credit rating union team frequently put in the time to listen attentively to members' issues and offer customized referrals based upon their individual demands.

One secret element of personalized client service at cooperative credit union is the emphasis on monetary education. Lending institution reps are dedicated to assisting members understand different financial items and solutions, empowering them to make informed choices (Wyoming Credit Unions). Whether a participant is looking to open up an interest-bearing account, make an application for a car loan, or prepare for retired life, cooperative credit union supply personalized assistance every step of the method

Moreover, lending institution often go the extra mile to make sure that their participants feel valued and sustained. By building strong connections and cultivating a feeling of neighborhood, credit unions produce a welcoming setting where participants can rely on that their financial well-being remains in excellent hands.

Strong Neighborhood Emphasis

With a dedication to supporting and fostering neighborhood links community efforts, lending institution prioritize a strong community emphasis in their operations - Credit Union Cheyenne. Unlike standard financial institutions, debt unions are member-owned financial institutions that run for the benefit of their members and the communities they serve. This distinct structure permits lending institution to focus on the health of their participants and the local community instead of exclusively on generating earnings for exterior investors

Cooperative credit union frequently participate in various neighborhood outreach programs, sponsor local events, and team up with other organizations to resolve neighborhood needs. By purchasing the neighborhood, cooperative credit union aid boost neighborhood economic climates, develop work possibilities, and enhance total lifestyle for citizens. In addition, cooperative credit union are recognized for their participation in monetary literacy programs, using educational sources and workshops to assist community participants make educated economic choices.

Financial Education and Assistance

In advertising monetary literacy and supplying assistance to individuals in need, debt unions play a vital function in equipping communities towards economic stability. One of the essential advantages of credit rating unions is their focus on offering economic education to their participants.

In addition, credit history unions often provide support to participants facing financial troubles. Whether it's with low-interest car loans, versatile payment plans, or economic counseling, lending institution are committed to assisting their members get rid of difficulties and accomplish economic stability. This customized approach collections cooperative credit union aside from standard financial institutions, as they prioritize the economic wellness of their members most of all else.

Member-Driven Choice Making

Members of cooperative credit union have the possibility to voice their opinions, give responses, and also compete placements on the board of supervisors. This level of involvement promotes a feeling of possession and community among the participants, as they have a straight impact on the direction and policies of the credit history union. By proactively involving participants in decision-making, cooperative credit union can much better customize their solutions to satisfy the distinct demands of their neighborhood.

Eventually, member-driven choice making not only enhances the total participant experience but likewise promotes openness, trust fund, and liability within the cooperative credit union. It showcases the cooperative nature of lending institution and their commitment to serving the best rate of interests of their members.

Final Thought

In conclusion, credit scores unions supply an engaging choice for economic stability. With reduced costs, affordable prices, customized client service, a strong area focus, and a commitment to financial education and aid, lending institution prioritize participant benefits and empowerment. Through member-driven decision-making click here for info processes, credit scores unions advertise transparency and responsibility, guaranteeing a steady economic future for their members.

Credit scores unions stand as columns of economic security for several people and areas, offering an unique approach to banking that prioritizes their members' health. Unlike standard financial institutions, credit unions are member-owned monetary organizations that operate for the benefit of their participants and the neighborhoods they offer. Furthermore, credit report unions are recognized for their involvement in monetary literacy programs, using instructional resources and workshops to assist area members make notified economic decisions.

Whether it's via low-interest lendings, versatile payment strategies, or monetary counseling, credit rating unions are dedicated to aiding their participants overcome challenges and attain monetary security. With reduced costs, competitive prices, individualized client solution, a strong neighborhood emphasis, and a commitment to financial education and learning find out this here and assistance, credit unions focus on participant benefits and empowerment.